A is for audience...

Part II | Category Buyers | Out-of-Market vs. In-Market Audiences

In my last post I walked through how in an ideal world a media planner should get to know the Attitudinal Audience, the Pen Portrait or the Persona… but aim to plan, deliver and measure their media against the broadest possible group of category buyers their budget allows.

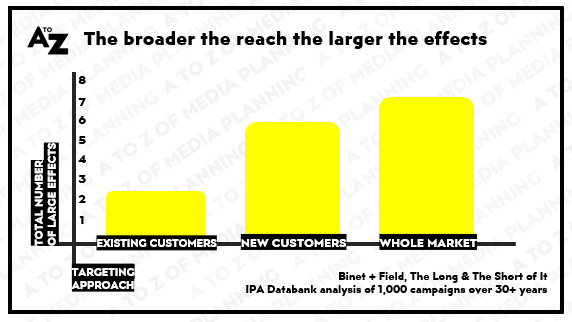

Why? Because the broader the reach of your advertising, the larger the effects.

As evidenced by the IPA through Binet & Field’s analysis of the IPA Databank as part of their paper The Long & The Short of It.

Which is why you should supplement your understanding of the Attitudinal Audience such as Jenny, Mike, the Progressive Premium or your Pleasure Seeker I touched on in Part I with an understanding of who is actually purchasing from the category and how they go about doing so when they are in-market.

To get a better understanding of a category’s dynamic, I find it helpful to pull apart the market into 3 different groups as indicated by the graphic below: -

CATEGORY BUYERS | The total group of buyers of a category, sector or segment

In the car-insurance market, being anyone that owns a car and requires it to be insured

OUT-OF-MARKET AUDIENCE | People that buy from the category, but aren’t in-market at the moment In this case people that already have a policy, but won’t be looking to buy another until renewal.

IN-MARKET AUDIENCE | People in-market to buy now, or researching to buy soon

In this case people searching insurance aggregators and getting quotes, to stop being scalped by their existing provider once their policy automatically renews.

All pretty simple right?

Well unfortunately the real-world starts to rub up against best-practice, however well evidenced it might be.

Whilst “anyone with a car” might be the right categorisation of an audience to plan and buy media against for a multinational with the resources to reach them and policies that are attractive to all – from experience most businesses or budgets can rarely put that keystone principle of marketing science into action.

Therefore how you define, refine and represent the segment of buyers within the broader category you’re attempting to steal share within, or grow into, starts to become really important as you plot a path to growth.

To do this when working on a pitch or with a new client, I’ve found constructing what I call a Category View a helpful way of figuring out what’s going on in a market - in an attempt to spotlight who or what might be doing well, or not so well, and try to highlight what the opportunities and potential barriers to growth might be.

Depending on what data and time is available I would go through a set of steps like this: -

1. Size everyone in the market

In the below case being alcohol, or spirits drinkers

2. Pull apart Category (e.g. Alcohol) + Segment (e.g. Spirits/Whiskey) buyers relative to Brand + Competitor Buyers (e.g. Jack Daniels, Johnnie Walker etc)

3. Plot the Rate of Growth in these different segments and the $ value they are generating

4. Determine how these segments differ by age, life-stage, demographics,

attitudes, rate of purchase, place of purchase or the need-states driving purchase

If we take the Whisk(e)y segment of the spirits category as an illustrative example (complete with imaginary data and cringey Unsplash stock imagery in-place) you would be able to quantify + qualify that Whisk(e)y is growing slower than its broader spirits contemporaries - perhaps owing to its inability to recruit drinkers beyond the male, pale and stale drinking reflectively in their leather-studded armchairs late at night.

Therefore, as a whisk(e)y brand in this market you might choose to focus on stealing share within a relatively stale category, or potentially disrupt yourselves and the wider spirits category at large by breaking into new occasions where younger, more diverse drinkers and their collectively larger wallets await.

Different choices, with different tactics and what would be radically different media plans (nevermind a likely overhaul of the brand strategy).

Classic agency tools such as TGI are helpful in constructing this view and understanding, but if you don’t have subscriptions to agency tools such as this, desk research and free tools from the likes of Facebook can build proxies that can size the volumes of people interested in most markets – and can often be more helpful in more nuanced categories such as fashion or entertainment.

Once armed with this information, you can then dive into figuring out the why behind what’s happening in the market you’re working in.

But we’re in A is for audiences, not I is for insights.

Diving into IN-MARKET AUDIENCES | Once you have a view of the size and the nature of the category you’re trying to win within, it’s good practice to ask yourself and your teams…

How many people are in-market at any given time? How often are they in-market? What brings them into market? Where and when is the product or service consumed or used, as opposed to just bought? Which aspects of their behaviour may make them available to reach in media at key points on their path to purchase? What is the customer faced with when they’re at the shelf, the bar or the shopping centre? Whose opinion do they value?

On a practical level an understanding of in-market audiences, what brings them into market and what influences them along the way can inform budget planning.

On an organising level this can become part of your market analysis and start to uncover the challenges that might need overcoming and what the associated tactics might be to resolve those challenges.

A couple of watch-outs…

The proportion of people “in-market” is dramatically different depending on the category you’re in - see this graphic below for some exaggerated examples

The breadth and depth of a customer journey, which creates the contexts media can connect to whilst they’re in-market vary greatly too

Whilst specialist research companies have long helped marketers understand the size and shape of in-market behaviour; increasingly the surveillance economy that has propelled Big-Tech to the top of the S&P 500 has taken this up to 11 and made it a whole lot faster and cheaper.

Self-service tools like those Facebook and Google provide mean anyone can access and construct a reasonable view of the in-market audience potential within most categories, and as if by magic handily service any tactics to activate these audiences along the customer journey through off-the-shelf media placements.

Little wonder they’re doing so well.

The ability to mine audiences and subsequently market to them with this precision, has led many marketers and the agencies that serve them to focus on picking off the lowest hanging fruit at the bottom of the funnel.

When they’re googling the difference between a Volvo XC60 or an XC40, browsing different cocktails, or searching for a new drop of limited edition Air Force Ones.

Beware though.

This type of technique being held up as the new way to do things, rather than a way of doing things in a new way, has seen some growing pains alongside the growth of digital marketing + media budgets.

Media budgets and production budgets have been un-necessarily burned and growth potential has been capped.

Why is this the case?

EXCESSIVE COST

In-market audiences tend to cost more to reach each person each time as advertisers crawl over each-other in ad auctions to reach “Electric Vehicle Intenders” or “Sneakerheads” with more confidence.

+ EXCESSIVE FREQUENCY

Chasing the same people around the internet, multiple times, to close a sale, with that pair of trainers or part-configured car tends to increase frequency over reach

= REDUCED REACH + RESONANCE

As $s are focussed on reaching smaller groups of people lots of times, rather than more people, more often, across the calendar year.

I’m exaggerating to make the point, but herein lies one of the biggest choices a media planner and budget holder has to make.

Balancing the levels of investment it might take to connect with all category buyers or the segment you’ve prioritised, when they’re going about their lives, in memorable ways, to build a brand that is more likely to come to mind in buying situations by default – with being present and compelling at key points on the customer journey when people are in-market to close a sale; because if you’re not there someone else might come along to steal that sale away from you.

How you allocate resources between these tasks is different by category, lifestage and marketing task.

Les Binet & Peter Field (read everything they’ve published as it’s all great) offer some useful pointers, that can be used as guardrails I’ve pulled out below.

If you have healthy budgets, these ratios are great guides to help inform allocations between “brand-building” vs. “sales-activation”.

To get to a more robust set of inputs into a media plan requires sense-checking the investment required to deliver meaningful reach, resonance and ultimately a response amongst the category buying base or segment of it as you’ve defined it.

Which points towards the last audience under consideration, Media Buying or Trading audiences that I’ll touch on in Part III to close out this first set of posts.

In this post I’ll walk through how the fundamental channels you might construct your plan trade their respective audiences, and what the implications are for constructing an effective media plan.

Until next time!